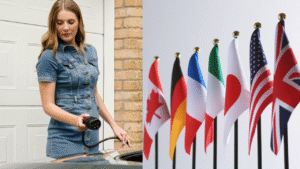

Who Is Winning the Global EV Race in 2025

Who Is Winning the Global EV Race in 2025? A Deep Dive Into the Electric Vehicle Revolution

Introduction: The Race That’s Redefining Mobility

Electric vehicles (EVs) are no longer the future—they’re the present. Around the globe, countries are investing billions to transition from internal combustion engines to electric mobility. With governments rolling out aggressive climate goals, manufacturers pouring resources into EV production, and consumers demanding cleaner alternatives, the question is no longer if EVs will dominate, but who will lead the charge.

This 1800-word guide breaks down the global EV race by country and region, comparing the leaders based on production, innovation, charging infrastructure, and sustainability. From Tesla’s reach in the West to BYD’s rise in the East, this is your full briefing on who’s truly winning the EV race in 2025.

China: The Dominant Force in EV Production

Scale and Manufacturing Might

China continues to lead the EV race in 2025, driven by its massive production capacity and early government support. The country accounted for over 60% of global EV sales in 2024, and that number is still rising.

Key Players

- BYD (Build Your Dreams): Now outselling Tesla globally in pure EV volume.

- NIO and XPeng: Known for smart features, fast charging, and battery swap tech.

Government Support

- Subsidies, incentives, and quotas pushed Chinese automakers to go electric early.

- Cities like Shenzhen have transitioned public transport fleets to 100% electric.

Smart Strategy

Unlike many countries, China controls much of the lithium supply chain, giving it strategic advantage in EV battery manufacturing.

EV Strengths: Production scale, battery tech, affordability, infrastructure expansion.

EV Weaknesses: Quality concerns abroad, brand recognition in Western markets.

United States: Innovation Powerhouse, But Catching Up

Tesla and Beyond

Tesla remains a global benchmark for EV innovation and range. However, new players like Rivian, Lucid Motors, and traditional giants like Ford and GM are fast expanding their EV offerings.

EV Legislation

The Inflation Reduction Act (IRA) of 2022 gave tax breaks and funding to boost EV adoption and battery production. In 2025, the U.S. is seeing:

- New Gigafactories in Texas, Georgia, and Nevada

- Over 50% of new car sales in California now electric or hybrid

Charging Network Expansion

Companies like Electrify America and Tesla’s Supercharger network are expanding, but rural areas still lack sufficient coverage.

EV Strengths: Innovation, battery range, self-driving tech.

EV Weaknesses: High cost, inconsistent infrastructure, slow traditional automakers.

Europe: Sustainability Leaders With Diverse Strengths

EV Market Penetration

Countries like Norway and Sweden are global leaders in EV penetration, with Norway recording over 80% EV sales in 2024.

Major Brands

- Volkswagen: Massive EV portfolio under its ID. series.

- Renault, BMW, Mercedes-Benz: Pioneering luxury and mid-range EVs.

Green Policy Backbone

The EU’s “Fit for 55” climate strategy mandates that all new cars be zero-emission by 2035. Generous incentives and CO₂ taxes encourage swift EV adoption.

Charging Superiority

Europe boasts one of the densest charging networks, especially in Western Europe, although Eastern Europe is still catching up.

EV Strengths: Sustainability commitment, public incentives, charging density.

EV Weaknesses: Slower tech integration compared to U.S. and China.

South Korea: Small Size, Big Impact

South Korea punches above its weight in the EV sector. It is home to Hyundai and Kia, whose EVs—like the Ioniq 6 and EV6—have received global acclaim for design, safety, and performance.

Battery Leadership

South Korea’s LG Energy Solution and SK On are among the top global battery suppliers, powering many global EVs including Ford, VW, and Tesla models.

Government Incentives

South Korea offers aggressive tax rebates and rebates for home charging units.

EV Strengths: Battery innovation, quality design, rising global trust.

EV Weaknesses: Smaller domestic market, lower export volumes vs. China.

Japan: Struggling to Keep Pace

Despite once leading the hybrid market with the Toyota Prius, Japan has lagged in fully embracing EVs.

Resistance to Change

Japanese automakers like Toyota and Honda were slow to shift from hybrid to full EV. Toyota only recently launched competitive EVs.

Battery Concerns

Japan has lost battery leadership to South Korea and China.

EV Strengths: Hybrid tech legacy, trusted brands, fuel-efficient design.

EV Weaknesses: Delayed EV rollout, limited charging infrastructure.

Rest of the World: Growing, But Trailing

India

India is focusing on affordable EVs and 2-wheelers. Tata Motors and Ola Electric lead local markets, and government policies support EV infrastructure.

Southeast Asia

Thailand and Vietnam are emerging EV manufacturing hubs due to cheap labor and new factories.

Middle East

UAE and Saudi Arabia are investing in EV infrastructure and startups as part of their post-oil strategy.

Smart Comparison Table

| Region | Market Share (2025) | Top Brands | Key Strength | Key Challenge |

| China | ~60% | BYD, NIO, XPeng | Scale + battery | Quality perception abroad |

| USA | ~15% | Tesla, Ford, Rivian | Innovation | Infrastructure gaps |

| Europe | ~20% | VW, Renault, Mercedes | Policy + charging | Tech development speed |

| South Korea | ~5% | Hyundai, Kia | Battery tech | Export volume |

| Japan | ~3% | Toyota, Honda | Hybrid heritage | Slow EV rollout |

| India | ~2% | Tata, Ola | Affordability | Charging infra, battery |

Who’s Really Winning?

If measured purely by volume, China is winning the EV race. With state backing, domestic brands, and control over battery raw materials, China has a lock on production.

But in terms of technology leadership, the United States still leads thanks to Tesla, autonomous driving R&D, and battery breakthroughs.

Europe remains the leader in regulatory transformation and public support, making it the greenest region per capita.

Each region is winning in its own way—but the true champion will be the one that balances scale, innovation, sustainability, and affordability.

Final Takeaway: Collaboration Is Key

As 2025 progresses, it’s clear that no single country can dominate every aspect of the EV transition. The real winners will be consumers—benefiting from a highly competitive, rapidly innovating global marketplace.

Collaboration between governments, tech companies, and automakers will define the next phase. The EV race is not about beating others to the finish line. It’s about everyone arriving together, cleaner, greener, and faster.

YOU MAY ALSO LIKE THESE POST

Post Comment